+ Cloud business achieves annual revenue of KRW 2.6802 trillion, up 15.4% YoY, driving revenue growth in the IT service business

+ The number of subscribers to Cello Square, a digital logistics platform, exceeds 24,625

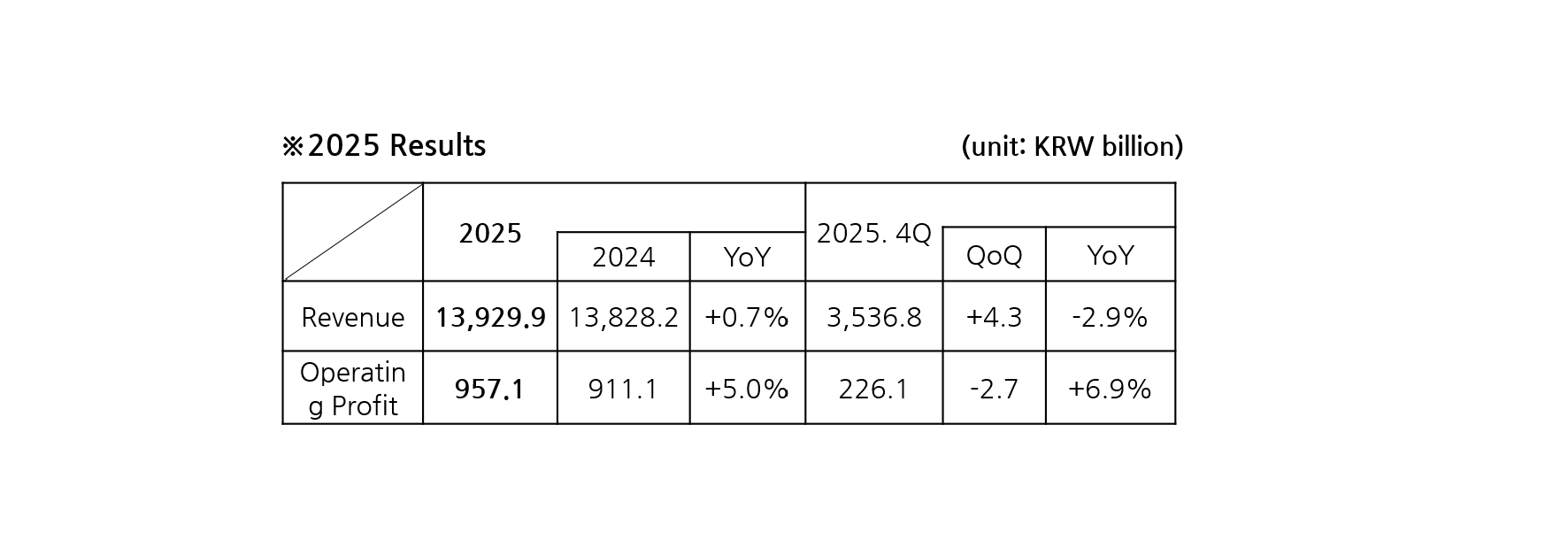

+ Fourth-quarter revenue and operating profit were recorded at KRW 3.5368 trillion and KRW 226.1 billion, respectively

On January 22nd, Samsung SDS announced its preliminary earnings for 2025, with revenue of KRW 13.9299 trillion and operating profit of KRW 957.1 billion, up 0.7% and 5.0% YoY, respectively.

In the fourth quarter of 2025, the company’s revenue was KRW 3.5368 trillion, and its operating profit was KRW 226.1 billion. The fourth quarter revenue decreased by 2.9% YoY, while operating profit went up by 6.9% YoY.

Among the company’s businesses, the IT service business achieved an annual revenue of KRW 6.5435 trillion, up 2.2% from the previous year. Cloud business revenue grew by 15.4% compared to the previous year, reaching a total of KRW 2.6802 trillion. Overall, the cloud business led the growth of Samsung SDS’s IT service business.

Within the cloud business, the company’s cloud service provider (CSP) business witnessed annual revenue growth driven by increased use of the Samsung Cloud Platform (SCP) and GPUaaS following the expansion of generative AI services; as well as the expansion of high-performance computing (HPC) and cloud network services.

Additionally, revenue growth in the Managed Service Provider (MSP) business was driven by cloud migration in the financial sector; winning generative AI service projects in the public sector; and expansion of global solution-based businesses, including Enterprise Resource Planning (ERP) and Supply Chain Management (SCM).

Amidst the continued decline in maritime freight rates, the logistics sector recorded annual revenue of KRW 7.3864 trillion, down 0.5% YoY, while operating profit dropped 6.2% to KRW 130 billion.

The number of subscribers to Cello Square, a digital logistics platform, grew by 27% YoY, with 24,625 companies using the service as of the end of 2025.

Leveraging its AI full-stack capabilities, covering AI infrastructure, platform, and solutions, Samsung SDS plans to continue the expansion of its AI and cloud businesses while enhancing competitiveness in these areas.

In the AI infrastructure sector, driven by growing demand for GPU and data centers, the company will launch GPUaaS offerings based on NVIDIA’s latest B300 and pursue the Design-Build-Operate (DBO) business, which offers strong scalability.

Additionally, Samsung SDS will focus on public Disaster Recovery (DR) implementation projects centered on the Daegu Center, while providing industry-specific services to enhance the competitiveness of its SCP.

In the AI platform sector, the company will support the adoption and expansion of generative AI among enterprise customers across a wide range of industries, building on the ChatGPT Enterprise reseller partnership agreement signed with OpenAI in December last year, the first of its kind among Korean companies.

In the AI solution segment, Samsung SDS has been providing Brity Works (a collaboration solution) and Brity Copilot (a generative AI service) to three government organizations -- the Ministry of the Interior and Safety; the Ministry of Science and ICT; and the Ministry of Food and Drug Safety -- through pilot services since November 2025. The company will expand the provision of these services to 57 central government agencies.

In the logistics business, Samsung SDS will further strengthen its air freight and contract logistics operations, while applying AI-based automation technologies to logistics operations and warehouse management.

Meanwhile, to enhance shareholder value and expand shareholder returns, Samsung SDS resolved at a board meeting to increase its dividend by 10% to KRW 3,190 per share. As a result, the criteria for designation as a high-dividend company are now met.

| 2025 | 2024 | YoY | 2025 4Q | QoQ | YoY | |

|---|---|---|---|---|---|---|

| Revenue | 13929.9 | 13828.2 | +0.7% | 3536.8 | +4.3% | -2.9% |

| Operating Profit | 957.1 | 911.1 | +5.0% | 226.1 | -2.7% | +6.9% |

(Unit: KRW in billion)