Samsung SDSA conducted a webinar around the topic of biometric authentication on Wednesday, March 14, 2018 with BioCatch and Thomson Reuters and moderated by media publisher, BankersHub. The webinar focused on biometric authentication solutions that enable multifactor step-up authentication for any transaction requiring identity confirmation.

For those that don’t know, a webinar is a marketing tactic that can help drive leads and can play a role in demand generation or building awareness of a company’s products or solutions. A webinar acts as a tool for customers and the market to do research when assessing a need, technology, or more specifically to this case, Samsung SDS Nexsign, a FIDO-certified biometric authentication solution. Overall, a webinar can help show a market or prospects exactly why they should know about a company and how that company can provide a solution for a problem they may face.

▲ Samsung SDSA begins their portion of the live webinar

There are a couple of different options in terms of how a webinar can be conducted. One way is when a company produces a webinar on their own, and the other format involves partnering with a media company. The advantage to partnering with a media company includes being able to leverage the contacts of that vendor to target a specific audience for the webinar. For this webinar, SDSA chose BankersHub (media publisher) that has a strong financial services audience interested in technology.

Those who were interested in attending SDSA’s webinar registered online and were then sent an email confirmation that detailed the date and time of the webinar in addition to a calendar invite for potential attendees in the United States. During the registration time period, Samsung SDSA emailed their existing marketing database to promote the webinar and also promoted it to a new audience using paid social ads.

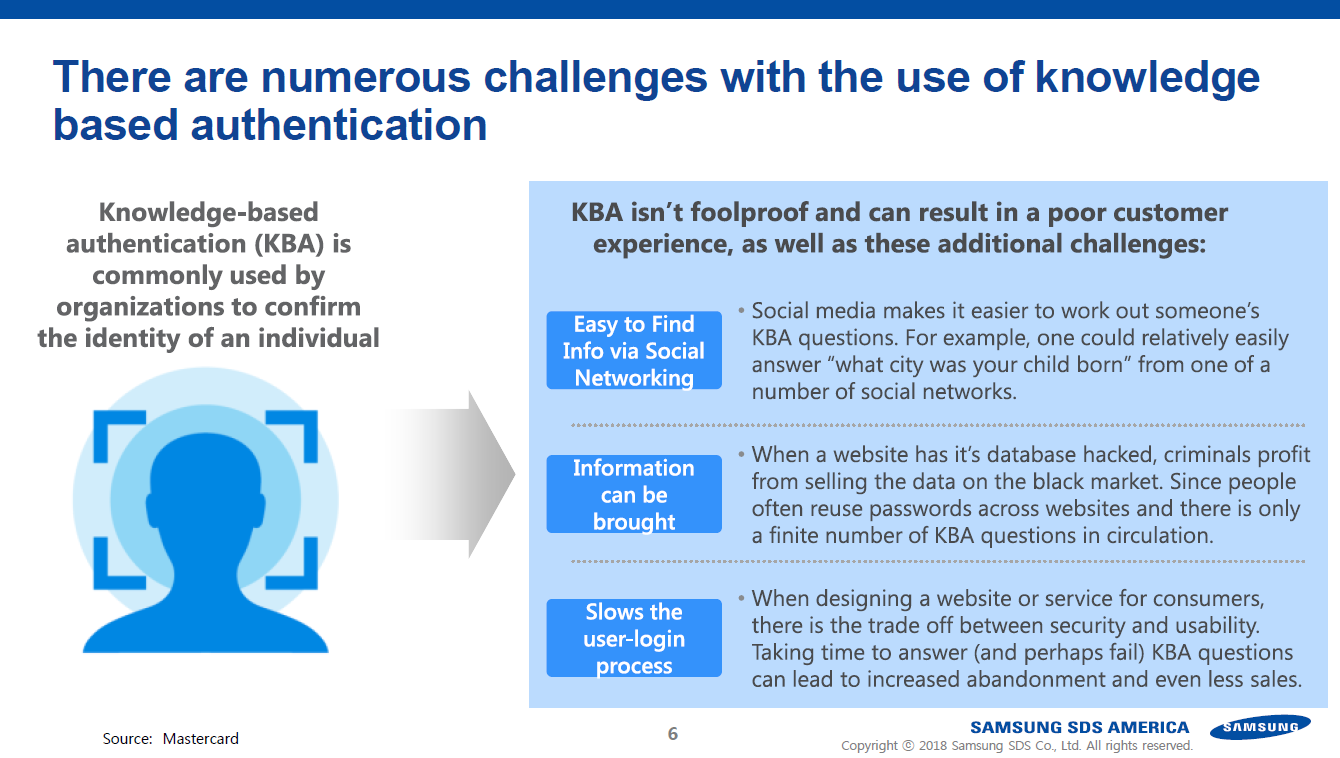

▲ A slide from Samsung SDSA’s portion of the webinar showing the challenges to relying on knowledge-based authentication (KBA)

- Easy to Find Info via Social Networking :

- Social media makes it easier to work out someone's KBA questions For example, one could relatively easily answer "what city was your child born" from one of a number of social networks.

- Information ca be brought

- When a website has it's database hacked, criminals profit from selling the data on the black market. Since people often reuse passwords across websites and there is only a finite number of KBA questions in circulation.

- Slows the user-login process

- When designing a website or service for consumers, ther is the trade off between security and usability. Taking time to answer (and perhaps fail) KBA questions ca lead to increased abandonment and even less sales.

Richard Lobovsky, Vice President of Enterprise Solutions at SDSA, kicked off the first portion of the webinar with an explanation of the positive impact and increasing use of biometric authentication in the financial services industry. When compared to biometrics, passwords and knowledge-based authentication (KBA) aren’t as foolproof against fraudsters and can also result in poor customer experiences.

Richard Lobovsky, Vice President of Enterprise Solutions at SDSA, kicked off the first portion of the webinar with an explanation of the positive impact and increasing use of biometric authentication in the financial services industry. When compared to biometrics, passwords and knowledge-based authentication (KBA) aren’t as foolproof against fraudsters and can also result in poor customer experiences.

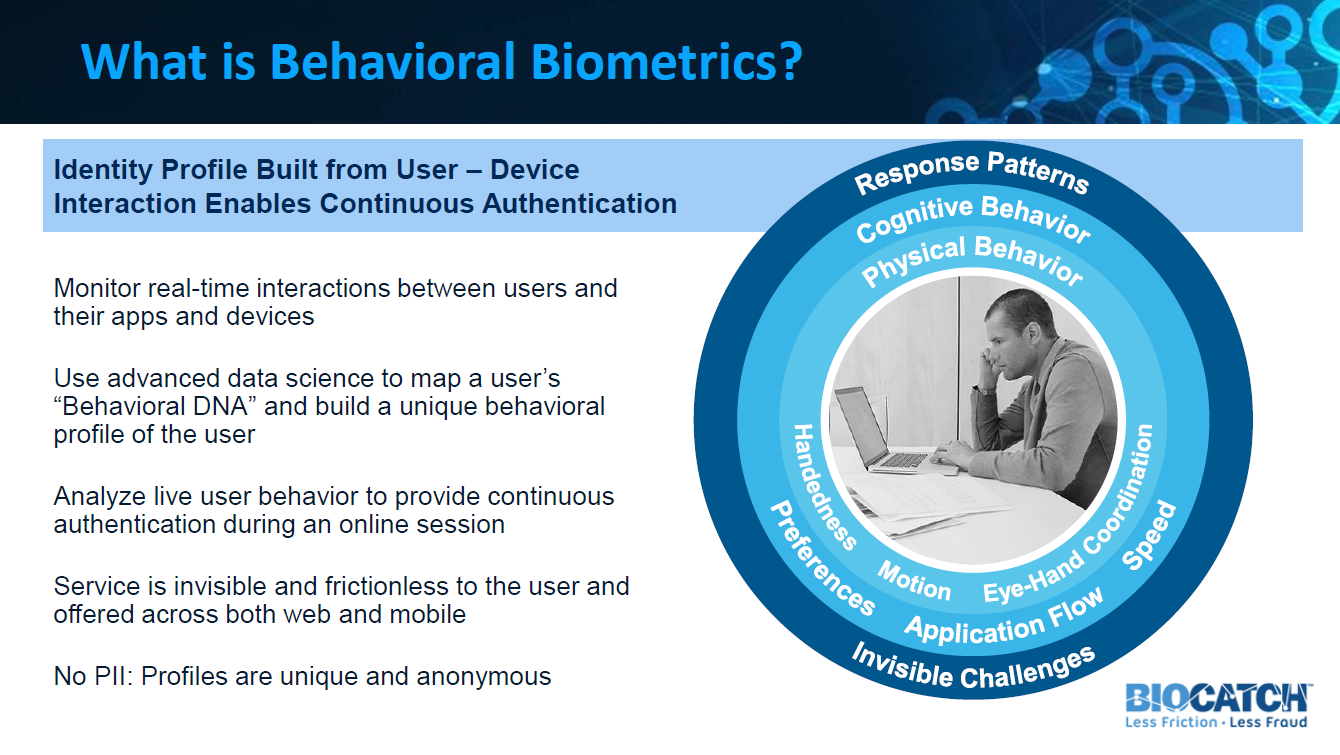

▲ A slide from BioCatch’s portion of the webinar explaining the role behavioral biometrics can play when creating an identity profile

The next portion of the webinar was presented by Frances Zelazny, Vice President of Marketing at BioCatch, and she went further into detail about behavioral biometrics* and how users would create an identity profile that enables continuous authentication based on response patterns, cognitive behavior, and physical behavior when using a device.

The next portion of the webinar was presented by Frances Zelazny, Vice President of Marketing at BioCatch, and she went further into detail about behavioral biometrics* and how users would create an identity profile that enables continuous authentication based on response patterns, cognitive behavior, and physical behavior when using a device.

* Behavioral biometrics provides a new generation of user security solutions that identify individuals based on the unique way they interact with computer devices like smartphones, tablets or mouse-screen-and-keyboard.

Lastly, Jen Singh, Senior Director and Head of Product and Strategy at Thomson Reuters, showcased how Thomson Reuters is utilizing Samsung SDS Nexsign in their flagship products that support mobile apps with authentication and security: Thomson Reuter Eikon and Thomson Reuters Westlaw.

Lastly, Jen Singh, Senior Director and Head of Product and Strategy at Thomson Reuters, showcased how Thomson Reuters is utilizing Samsung SDS Nexsign in their flagship products that support mobile apps with authentication and security: Thomson Reuter Eikon and Thomson Reuters Westlaw.

The webinar concluded after a Q&A section that opened the virtual floor to the 101 attendees of the webinar. For Samsung SDSA, the end of the webinar is just the beginning of another campaign that includes following up with those who registered for the webinar. These follow-ups will include more opportunities to see assets and content related to theme of the webinar and, for those who registered but did not attend the webinar, a chance to see the on-demand version.

This webinar was Samsung SDSA’s fourth webinar, joining a list that includes: two webinars that focused on Nexsign and were partnered with FindBiometrics and CA Technologies, and another webinar that focused on Enterprise Mobility Management (EMM). Samsung SDSA has a fifth webinar scheduled in partnership with Digital Dealer in April that will be targeting automotive dealerships in the United States.

By Staff of Marketing & Partner Svcs Group Alexander Stapinski of Samsung SDS(America)

By Staff of Marketing & Partner Svcs Group Alexander Stapinski of Samsung SDS(America)

▲

▲  ▲

▲ ▲

▲