How Pega DPA & blockchain can enable manufacturing warranty management claims

Blockchain is of particular interest to the manufacturing industry due to its benefits regarding verification and transparency. The potential use cases are ever expanding, from financial services to asset ownership, to intellectual property and to integration with the Internet of Things (IoT).

Warranty management has been one of the most significant expenses for manufacturing companies. Despite a reduction in the number of claims issued, there has been a noted increase in costs across the warranty value chain. Existing legacy systems are disparate, standalone requiring manual interventions and hand-offs, with zero immutability of records. The onus is transferred to the customer to prove ownership and warranty coverage to OEMs via physical invoices, contributing to decreased customer satisfaction, duplication of work and inability to handle counterfeiting and fraudulent claims.

The dual combination of DPA + blockchain aims to target these inefficiencies by optimizing the warranty. Organizations gain the power to track the part with a digital twin for the entire lifecycle of production -> distribution -> sale -> service -> recovery.

Such an automated warranty value chain is estimated to provide – (1) 50% - 70% reduction in document verification time (2) 40% - 60% reduction in fraudulent claims (3) 60% - 80% reduction in warranty information mismatch.

The Warranty Challenge

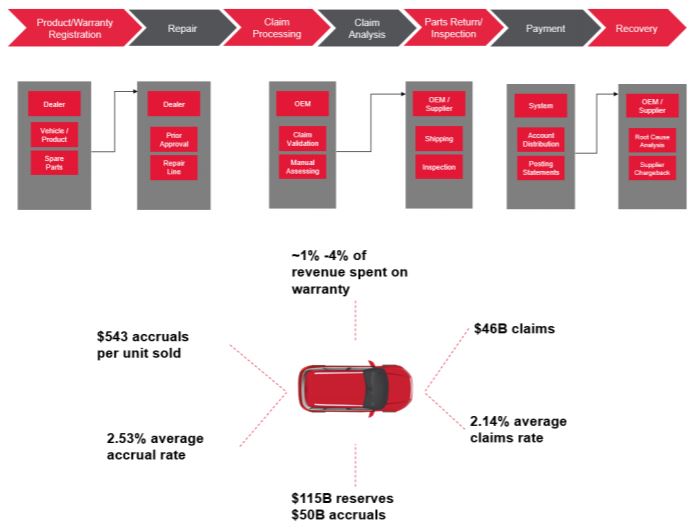

Managing warranty has now emerged as a key area in the aftermarket for manufacturers. Customers spend $2 trillion in warranted product sales on owned assets. 3%-4% of a typical manufacturer’s revenue is now spent on warranty management.

Warranty spend in the auto & discrete industry worldwide is up sharply. With reliable warranty expense data in hand from 24 of the world’s largest carmakers, we have calculated some worldwide metrics:

With slowing new car sales, there is a growth shift in the space of extended warranty, spare parts sales and over the counter parts and accessories. Firms generate an estimated 30–50% of their revenue from servicing products and which represents 45% of gross profits. However, with disruptions to the traditional dealership sales model with online and reseller marketplaces arises the challenge of counterfeit and fraudulent parts and claims.

For example in emerging markets such as India, the counterfeit auto parts industry is matching the growth rate of automotive sales. The fake spares industry in the latest fiscal year was estimated to be a whopping $3 billion (30-40% of the overall spare parts industry market share), while traditional sales for OEMs is just marked at $10 billion in this region. This has led to governmental agencies needing to intervene and mandate the manufacturers to enforce measures that help consumers and dealerships/distributors authenticate their spare parts.

Warranty Pain Points

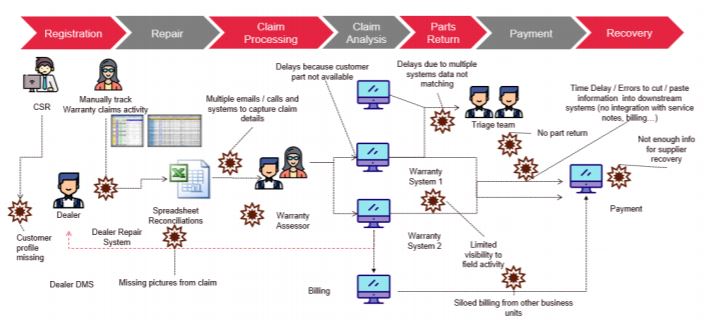

Warranty is a consumer experience involving manufacturing production, service, dealers, suppliers, as well as a large ecosystem of regulatory and product policies and decisions that must be executed to handle claims. Historically, warranty management has been relegated to an administrative back office function, and so everyone involved suffers from several challenges and “pain points” that include:

• Claims Processing Inefficiencies: Processing claims is too manual, administrative and wasteful. Manufacturing is under constant pressure to reduce warranty costs. This results in cost-cutting policies that are often detrimental to dealer, supplier and customer relationships. The responsibility of proving warranty coverage and origin of the part is shifted to dealers and suppliers respectively. This contributes to an increased percentage of a denials and appeals loop and incorrect cost recovery.

• Fraudulent Handling: Manufacturers and dealers also deal with fraud claims that could substantially add to the cost of warranty processing. The detection as well as prediction of potential fraudulent claims are important objectives for warranty. Another aspect of fraud causing concern for OEMs is around counterfeit spare parts. Failure to distinguish the fake parts right from the installation until the repair/claim step results in brand dilution, tarnished reputation and financial losses to manufacturers.

• Exception Handling: Packaged warranty systems are meant to provide standardized adjudication controls & process. They were not designed to handle the dynamism of exceptions required for specialized claim types such as service part warranty without custom code. Exceptions require rapid response and therefore manual workarounds abound. Organizations lose agility and visibility.

• Customer Churn: Perhaps most importantly, customers are churning due to poor warranty processing. Customer satisfaction declines with poor handling of claims. Sometimes the paperwork is lost, damaged, or erroneous. The customer experience is further aggravated when rigid company policies conflict with customer expectations. Customers lose or are unaware of eligible warranty coverages during a transfer/sale.

• Fleet Benefits: In addition to benefits for manufacturers and individual customers, fleet owners can benefit greatly by integrating service and warranty with OEMs for tracking original and after-market parts. OEMs can enhance the benefits of using original parts in the maintenance cycle of the life of any vehicle.

• Regulatory Compliance: The cost of regulatory compliance and reporting is climbing. Regulations keep increasing in complexity. There are also corporate policies that need to be addressed.

How Warranty Value Chains Work Currently

A value chain is a process that orchestrates various applications and participants through a journey of milestones towards a business objective. The following diagram illustrates the “as-is” challenges of the warranty value chain.

Illustrating a value chain, such as the warranty chain, does not mean it is modeled, digitalized and automated. Typically, the value chain is just “on paper” with no work automation monitoring, operational optimization, or aggregation of digital technologies to complete the end-to-end process.

The warranty ecosystem spans manufacturers, suppliers, dealers, field service technicians and perhaps the most important participant in warranty value chains: the customer.

Therefore, manufacturers are paying an increasingly high price of inefficiency while processing warranty claims that involve various participants.

The warranty chain inefficiencies described above primarily highlight specific issues within tasks or activities for resolving warranty claims. In addition, for the end-to-end warranty value chain, inter as well as intra organizational silos are pervasive.

This blog series highlights how two core digital transformation technologies can provide innovative, robust, and efficient solutions for warranty chain management. These two technologies are digital process management and blockchain.

Kapi has over 20 years of IT industry experience ranging from financial services, manufacturing, IoT, analytics, and mobility. He's now driving business in the world of blockchain.

- Four Big IT Transformations for Enterprise Agility

- An Agile Approach, the Core of Corporate DT for Working Culture Innovation

- Digital ESG, a Critical Success Factor for ESG

- Conversational AI War Begins. Who Will Be the Winner?

- What Is Matter, the New Smart Home Standard?

- 2023 Forecast for Technology Trends