You can see articles about Amazon almost everyday. You can read about Amazon Go's unmanned stores, Dash buttons, aircraft purchases for drone delivery services, Amazon acquiring WholeFoods for two-hour delivery, investing in autonomous driving, and even Amazon introducing the Buy with Prime service a few days ago. I was wondering what blueprint Jeff Bezos has in his mind. This article will take advantage of the opportunity to peer into his mind.

Image source : GeekWire

Image source : GeekWire

In 2021, Amazon earned $469 billion in sales and $33 billion in net income, accounting for 41% of the US e-commerce market.1)

The largest reason for today’s great performance is the success of the flywheel strategy. ‘”Flywheel” is the growth strategy for Amazon, reminding Amazon employees of Bezos’ sketches shared on napkins over meals with his executives every week. It explains the flywheel model that shows that a wide variety of cheap products and fast delivery will satisfy the customer experience demands, and then more customers will be attracted with more sellers following suit, which decreases the sales prices due to competition between sellers. This in turn decreases the delivery costs with the increased economy of scale and, eventually, improves the customer experience.2)

Image source: tool4seller.com

Image source: tool4seller.com

In 2005, the company launched a free delivery subscription service called “Amazon Prime.” Prime members can receive their orders within two days, and some members in some regions can even receive their food within two hours through Prime Now. Amazon Prime members accounts for 65% of Amazon shoppers or 200 million shoppers (as of April 2021)3), showing the consumer needs for cheap and fast delivery. These needs are referred to as the “Amazon Effect,” and Amazon's competitors are presenting their own versions of Prime membership services and struggling to provide two-day delivery while Amazon is getting ahead with its same-day and two-hour delivery services.

To actualize such delivery services, Amazon makes a huge investment in the entire ①distribution, ②storage, ③and shipping infrastructure. Now, there is no doubt we think of Amazon for smart supply chain.

① Retail: Go Offline beyond Online Market

Amazon does not hesitate to try and test new technologies to meet expected demands, the first factor in the supply chain.

Amazon Dash Catches the Accurate Demand

Image source: vox.com

Image source: vox.com

Amazon launched a Dash button equipped with a Wi-Fi feature in March 2015. Without needing to log in online or on mobile devices, simply pressing the Dash button triggers all processes automatically from ordering, payment, and delivery for a certain product. The Dash button is widely used for detergents, tissues, kitchen towels, batteries, beverages, and diapers. The button orders a certain item from a specific brand. So, it is effective in creating customer lock-in.

However, Amazon does not manage the button only for customer lock-in. Generally, SCM forecasts customer demands at the time of taking orders. Strictly speaking, this timing is much later than the actual point consumer’s needs arise. In this sense, the Dash button synchronizes consumption patterns with the actual demand patterns to provide accurate demand information.4)

Brick-and-mortar Amazon Go, Fresh, and Style stores for customer data acquisition

Image source: Daily Post

Image source: Daily Post

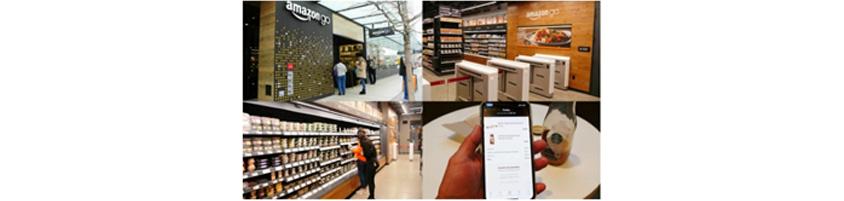

Amazon Go is a brick-and-mortar store that was launched in December 2016 to trigger autonomous payment when consumers walk into the store, pick up, and depart with the product without paying through a cashier.

Looking into how Amazon realized an unmanned payment, we can see how much Amazon focuses on customer data for demand forecasting. Amazon would insert RFID chips into every product if the purpose was unmanned payment only. However, it did not. The company monitors consumer behavior centering around cameras at the stores (computer vision) and sensors (sensor fusion), analyzing the collected data through deep-learning technology to identify customer's tastes, purchasing patterns, and intentions. The results are all used for demand forecasting.5)

Amazon is expanding the area of these kinds of brick-and-mortar stores into food stores “Amazon Fresh” and clothing, accessories, and apparel stores “Amazon Style.”

Amazon Eco for Amazon’s Choice Recommendation

Image source: Amazon

Image source: Amazon

Amazon promotes various campaigns for voice orders through Eco speakers to boost the product's share. Many products ordered through Eco were cheaper than when purchasing the same product with the same specifications.

The reason for promoting Eco like this is not only for attracting customers. Rather, it is for managing demands (demand shaping). Demand shaping is not just passively forecasting demands but directing the existing demands into new products. For example, when a consumer orders a battery through Eco, the system constantly recommends Amazon Choice (products Amazon wants to sell) and Amazon Basics (Amazon’s PB)6)

Reaching for the manufacturing industry, Amazon Basics

Image source: Amazon

Image source: Amazon

Based on the demand forecast capacity, Amazon launched its PB products, Amazon Basics, in 2009. Products coming in Amazon Basics labels range from thousands of daily necessities, supplies, clothing, kitchen utensils, and charging cables to home appliances. The company even adds an Amazon Basics portfolio or stops producing the existing products by analyzing what consumers search for, click, or buy, what and when they buy with the Dash button, and the consumers' behavior patterns in Amazon Go stores.

The products benefit customers by providing quality products at reasonable prices. It is not good for manufacturers/sellers. Because Amazon will replicate and sell products that achieve success and are easy to produce as an Amazon Basics version.7)

② Warehousing: Advanced warehouse management, Fulfillment

Image source: Amazon

Image source: Amazon

Back in the days when the industrial paradigm was manufacturing, the warehouse existed only as a warehouse. It was important to store as much as possible in a smaller place. The warehouse in the e-commerce era transformed itself into a fulfillment center for meeting the customer needs of receiving various types of products in a short period of time. The fulfillment center performs complex processes to pick up, pack, and label various types of products for personalized services.8)

This kind of convenience has higher costs. However, Amazon uses economies of scale (Amazon-size scale) to provide cheaper products that its competitors cannot keep up with.

Scale

Image source: The Business Insider

Image source: The Business Insider

Amazon has 233 fulfillment centers, 83 assortment centers, about 400 delivery stations in the United States. The total size of all those facilities is 173 million ft.2 in the United States alone and globally 288 million ft2. For your information, the 8th generation fulfillment centers are the equivalent to the size of 30 football fields. 9)

FBA(Fulfillment by Amazon)

Image source: The Business Insider

Image source: The Business Insider

Sellers face three challenging logistics issues when selling products online.

1. Where should we store stocks?

2. How should we pack ordered products?

There is growing needs for diverse items in combined shipping. The offline individual sellers find it hard to respond to such customer needs.

3. How to deliver the product?

Should we do our own? Or should we delegate and pay for the service? When we are unsure whether we can succeed in online selling, we find it hard to make large investments in the warehouse and supply chain. Amazon chooses to use paid warehouse and supply chain services, which is called FBA. You can think of it as applying the cloud business model called AWS to logistics issues. Sellers can focus on marketing while FBA takes care of storage, packing, and delivery.10)

Amazon offers free shipping for the FBA using products labeled with Prime stickers, and consumers do not seek products without Prime stickers. Therefore, sellers can’t sell or deliver their products if they does not use FBA.

FBA allows sellers to easily join the Amazon platform but make it hard to leave it to solidify its status as the selling platform and ensures a uniform customer experience, regardless of who is the seller, and passes the costs derived from it.

Push-Pull Strategy

The key to the fulfillment center is establishing distribution centers across the United States to form its retail supply chain, and promoting a Push-Pull strategy based on the stocks in each distribution center to maximize the efficiency of the supply chain management.11)

- Push: Supply strategy based on forecasts to assign stocks for each region before taking orders to provide fast responses. However, accuracy in demand forecasting is important because excessive stock-induced cost issues may arise.

Push products with higher demand through fulfillment centers in the regions with higher populations, including New York.

- Pull: Strategy for products with lower demand to execute separate logistics chains to deliver directly from manufacturers’ distribution centers to consumers rather than Amazon distribution centers (Direct Fulfillment).

Amazon Direct Fulfillment

Amazon identified that normal demand forecasting could not help stock management because online shopping volumes spiked,leading to a shortage of space in the fulfillment center and some products with skyrocketing demands, including face masks. So, the company encourages suppliers to sign up for the Direct Fulfillment program using the pull method as a backup plan. It encouraged the FBA to use the push method before the coronavirus pandemic, and, it seemed to change the approach in the face of surging online shopping volumes.

Direct Fulfillment is also called the drop shipping order processing program. The original drop shipping is performed by the third sellers rather than the manufacturer to list the manufacturer’s products on e-commerce websites and blogs through their marketing capacity and make an order to have manufacturers deliver the products to the customer. The well-known drop shipping platform is Shopify.

Image source: Boxme Global

Image source: Boxme Global

Amazon Direct Fulfillment program adds a few options.12)

- Direct Fulfillment products are considered Prime products.

- It is a significant strategical change compared to the past before the coronavirus pandemic, when only FBA products were Prime products.

- Directly receives products through EDI provided by Amazon to manage orders and stocks.

- Amazon takes care of all customer services and refunds.

- Amazon pays all delivery fee.

Managing Chaotic Storage Based on Data Forecasting

Image source: SKU VAULT

Image source: SKU VAULT

Amazon’s storage centers are more than 100,000 ft. To store and manage stocks in this huge space, Amazon chooses the “chaos” storage method. Based on the forecasts on future stocks and orders, the company provides handheld devices with bar code scanners to its workers and encourages them to stock the incoming products nearby random spaces and pick up the products later through optimized foot traffic.

This confusing chaotic storage method utilizes an average of 92-94% of the space. This figure is well above the other distribution centers’ 50-70% space utilization.

Also, the chaotic storage method minimizes human error. The previous sorting model often faced mistakes in that workers picked up a similar but different product on the same shelf where the desired product was located. However, in nature, chaotic storage allows for a significant decrease in human error because workers can identify the products with ease from among the unfamiliar products.

Another strength is unskilled beginners can enjoy easy work. Because they can stock the products near them and pick up the products later by following the instructions sent to the handheld devices.13)

Building a Digital Logistics Twin with Nvidia Omniverse

Image source: Nvidia

Image source: Nvidia

Amazon’s 200 or more fulfillment centers deal with tens of millions of boxes a day and use 500,000 or more Kiva systems, the shelving robot in its dealings. The shelf where the product is stored moves to the point where the worker is located, and the worker picks up the product from the container on the shelf. Amazon uses the Omniverse platform supporting artificial intelligence to build digital twins and optimize the design and flow of its fulfillment centers through endless simulation to support workers with smarter shelving robots.14)

③ Amazon Trying to Reach the Shipping Industry

The shipping industry is greatly affected by the provider's network. The key competitiveness in the shipping industry is economies of scale. The larger the scale of large hub terminals and automating assortments that are built, the greater reduction in cost. So few retail companies provide their own delivery services even in the current circumstances that e-commerce volumes have spiked. Many companies, including Amazon and Alibaba manage their own distribution centers. However, even those companies often rely on professional shipping companies’ delivery services.

Now, Amazon is expanding its territory to the delivery industry with the Delivery By Amazon (DBA) service. It reduces collaboration with logistics companies, including FedEx and UPS and strengthens the last mile (the very last contact point) delivery services.

We Will Manage Our Own Air Freight, Amazon Air

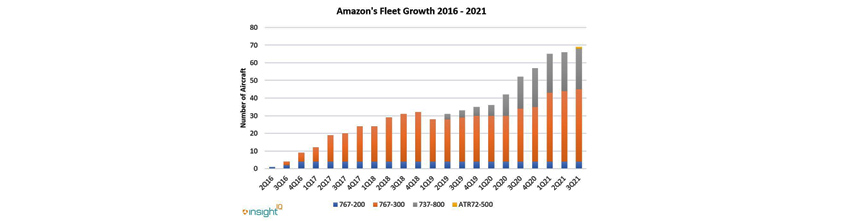

Amazon built its own delivery service system for last mile delivery, including thousands of cargo vans, established the freight airlines Amazon Air in March 2016, and launched an air shipping service with 20 leased aircraft. It purchased 15 aircraft from Delta Air Lines and Westjet between September 2020 to January 2021 to adapt for cargo use. As of 2022, it has 97 aircraft and has ordered eight aircraft, retaining more aircraft than Asian Airlines (82 aircraft).4) In 2028, it will have 200 aircraft, making it comparable with UPS or FedEx in scale.15)

Image source: Insight IQ

Image source: Insight IQ

Amazon is building an airline hub in Kentucky using $1.5 billion, which can accommodate 100 aircraft and manage 200 daily flights. Last year, it built an air shipping network consisting of seven cities based in four European countries, such as Germany, France, Italy, and Spain.

This capacity has allowed Amazon to offer a third-party delivery service (Logistics as a Service) via Buy with Prime (explained in the last chapter), rising as a new competitor of FedEx and UPS. Of course, Amazon has a long way to go to catch up with those companies that retain 500-600 aircraft. However, the existence of retailers that want stable and fast delivery services allows Amazon to build a niche logistics market.

Sharing Economy Type Logistics, Amazon Flex

Image source: Bloomberg

Image source: Bloomberg

Amazon started the Flex service in 2015 to promote one-day delivery. Individuals contracted with Amazon deliver Amazon products with their vehicles and are compensated $18-25 per hour. It’s similar to the Baedal Minjok food delivery drivers. Currently, Amazon manages Flex services in 50 cities in the United States.16)

The company announced it had tested a direct fulfillment type consignment delivery service, delivering products from local retail shops instead of a local logistics hub unlike the conventional Flex service used to do.

While first mile delivery plans first and delivers on a larger scale, the last mile is uncertain about everything. So, it might be only natural to introduce sharing economy services in last mile logistics.

Autonomous Driving Technology and Delivery Robots

Image source: Wonderful Engineering

Image source: Wonderful Engineering

Amazon has invested inautonomous technology and delivery robots to reduce the most costly (account for 28% of the entire supply chain expenditure) last mile costs 5), which represents 40% or so of labor costs.

- On June 26, 2020, acquired autonomous vehicles startup Zoox for $1 billion17)

- Made an investment in Aurora Innovation and Rivian Automotive18)

- Retains 210 patents regarding autonomous driving19)

- In 2019, tested an autonomous delivery robot, Amazon Scout20)

- In 2020, tested robotic taxis in Guangzhou, China, in collaboration with the Chinese autonomous vehicle startup WeRide21)

- In 2020, disclosed electric vehicles for delivery in collaboration with Rivian Automotive, expected to run the vehicles in 202222)

- In 2020, acquired a license for drone delivery from Federal Aviation Administration23)

Exclusive Amazon Ecosystem

Amazon uses its scale and technology to offer logistics services (Logistics as a Service) in a cheaper and more convenient way. So, the sellers find it easy to be involved in the Amazon platform but hard to exit from it. Therefore, many experts define the Amazon ecosystem as “closed (exclusive).” Not using Amazon means sellers can’t sell or deliver products anywhere around the globe.

Amazon charges 10-15% of referral fees with zero concern for marketing and logistics at a glance. However, the shared opinion of large sellers is, actually, they have to pay 35-48% of the fees of the final sales price, considering the ads, FBA fees, and refund fees.24)

Further, Amazon exclusively possesses the customer data, having manufacturers and sellers rely on Amazon for information necessary for forecasting demands and product planning.

Counterattack from Shopify, the Seller-friendly E-commerce Platform

Why is this the case? In November 2019, Nike officially announced it won’t supply Nike products through Amazon. The movement was extremely bold in that 50% of Nike's online sales were made through Amazon back then. That was the start of Nike's Direct to Customer (D2C) strategy. The company achieved success by increasing their online sales by 84% in 2020.25)

Nike's success left other manufacturers thinking about exiting the Amazon ecosystem and brought its attention to Shopify, an SaaS-based e-commerce platform that makes online shops, having sellers as its clients, which is unlike Amazon that prioritizes end customer's satisfaction.

Image source: Repricer express by eDesk

Image source: Repricer express by eDesk

Shopify allows sellers who need more IT understanding on hosting or coding to create their website, easy listing, coupon creation, order processing, and integration with partners, including marketplaces, fulfillment, delivery, and marketing. Also, it delivers orders within two days through its logistics system across the United States, like Amazon FBA.

While Amazon has forced the lowest price and launched PB products (Amazon Basics) by copying other products, Shopify has focused on the optimized branding of each seller. Sellers cannot expect to grow with Amazon, but with Shopify, they can. Recent New York Times articles wrote that some sellers are starting to leave Amazon, and this trend may soon cause Amazon and Shopify to become direct competitors.

In 2020, Shopify saw an 82% increase in sales to become the second-largest e-commerce platform. Still, Amazon recorded $386 billion in the same year, and Shopify only $2.9 billion only. Thus, it is smaller than the size of David, who fights with Goliath.26)

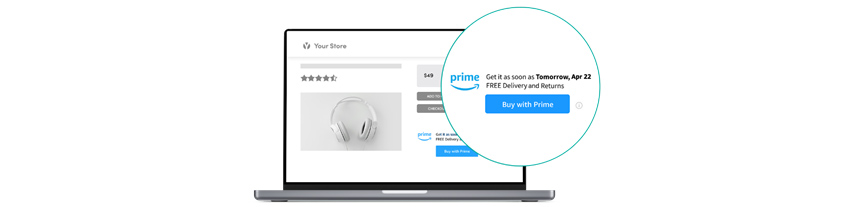

Amazon Starts to Keep in Check with Shopify and Other Competitors in the D2C market with Buy with Prime

Image source: Repricer express by eDesk

Image source: Repricer express by eDesk

Amazon does not want to allow the counterattack from Shopify. It launched the “Buy with Prime” service on April 21, 2022. The model offers the Prime Fast Delivery option and allows Amazon Pay payment for products sold by external sellers exposed on their website with the Prime logo. In other words, Amazon Prime members can enjoy one-day or two-day free shipping on the other websites run by sellers that do not sell their products via Amazon. Sellers can conveniently enjoy Amazon’s logistics service (logistics as a Service) without thinking of complex investments in logistics. However, it means they must follow the “unwritten Amazon way rule.”

A few years ago, when Amazon launched Amazon Flex, it explained it wanted to increase its delivery capacity rather than replace the existing shipping companies. It did enter the same shipping market of FedEx, UPS with Buy with Prime. Both Toys “R” Us and Borders signed an e-commerce partnership agreement with Amazon but went bankrupt.

How about Korea?

Korea is one of the few countries Amazon struggles to enter. It is the fierce battlefield of retail companies, including NAVER, Coupang, Gmarket, 11st, and SSG. Among them, Coupang follows the Amazon strategy, and Naver Smartstore is similar to the Shopify model added with search function. Amazon approaches with the oblique strategy of global selling in Korea where its strong competitors compete. Global selling is a support program offering the Amazon Global Selling website, training materials, FBA for Korean suppliers to enter the global market.

Conclusion

Amazon has got a plan. Its activities, including buying aircraft, acquiring Wholefoods, introducing Buy with Prime, and managing global selling programs, are all for building the “Amazon Way.”

There is a growing trend of sellers seeking omni-channels after the coronavirus pandemic. Surely, selling products on Amazon to enter the global e-commerce industry is the most simple and convenient method. However, Amazon does not stand with the sellers.

Its superpower comes from its customer data and scale. An e-commerce strategy that manufacturers take control of is needed to collect customer data. Even though it may be a hassle, manufacturers should manage their partnership with companies in various locations and channels and collect data from the seller's platform. For example, they need to diversify sales channels and collect their own customer's data through the drop shipping method, build smart logistics platforms, and use logistics companies within the platform rather than delegating their entire logistical service to FedEx or UPS. They need a strategic approach to distributing, managing stocks, delivering products to collect customer data, increasing product competitiveness, and improving customer satisfaction.

References

1) 2021 Annual reports on the Amazon homepage

2) tool4seller, How to move the Amazon flywheel: Everything You Need to Know for 2019 (November 1, 2019)

3) Tech Recipe, Amazon Prime Members Surpass 200 Million (April 19, 2021)

4) What is the Key to Amazon’s Growing and Outperforming Wall Mart? “3I” Innovation, Dreaming of Transforming All Supply Chains, October 2017

5) How the Amazon Go Store’s AI Works, Ryan Gross, June 7, 2019

6) AMZ Advisers, How Amazon Alexa Selects Products to Buy, March 1, 2018

7) The New York Times, How Amazon Steers Shoppers to Its Own Products, June 23, 2018

8) BeyondX homepage, Why Is Amazon Increasing Its Distribution Centers in New York?, May 27, 2021

9) Korea International Trade Association, New York Branch, American Company Amazon’s Global Retail Strategy Analysis, March 1, 2021

10) Medium, How Amazon Will Dominate the Supply Chain, August 23, 2018

11) eSellerHub, How Amazon Is Reshaping Supply Chain Management Innovatively? February 26, 2021

12) Feedvisor Homepage, Amazon Direct Fulfillment

13) Logistics Trend, Data-based Order Picking, June 17, 2021

14) Logistics Trend, Logistics Digital Twin Using Nvidia “Omniverse” platform, April 28, 2022

15) SupplyChainDive, Amazon Air's fleet expansion is a bid for logistics domination, June 4, 2020

16) How Amazon Will Dominate the Supply Chain, August 23, 2018

17) INSIGHTS by GREYB, Zoox Acquisition Can Help Amazon Build an Army of Last Mile Delivery Robots and Save $20 bn Annually, December 20, 2021

18) Seeking Alpha, Amazon confirms stakes in Rivian, Aurora Innovation, Air Transport Services and Vital Farms, February 3, 2022

19) Brunch, Does Amazon Entering the Mobility Industry? September 20, 2019

20) Robot News, Amazon Expands Scout Robot Delivery Tests, July 26, 2020

21) Case Study of the Amazon homepage, WeRide Speeds Autonomous Driving Machine Learning Model Training from Weeks to 12 Hours on AWS, 2020

22) CNBC, Amazon begins road testing Rivian electric delivery vans in San Francisco, March 18, 2021

23) CNBC, Amazon wins FAA approval for the Prime Air drone delivery fleet, August 31, 2020

24) Logistics Trend, “The Delivery Method is Changing” 2020 Global E-commerce Issues, April 9, 2020

25) Economist, Why Nike Abandons Retail Conglomerate Amazon (March 25, 2022)

26) Retail Sector, Three reasons to monitor the battle between Amazon and Shopify, February 22, 2022

▶ The content is protected by the copyright law and the copyright belongs to the author.

▶ The content is prohibited to copy or quote without the author's permission.

Samsung SDS Marketing Insight Group

Based on many years of business planning experience, she identifies opportunities for various Samsung SDS products and markets them. She is No. 1 on the blacklist, and is always poking her nose into other people's business in product planning and sales

- Leading the Innovative Smart Logistics - Smart Logistics Media Day & Cello Conference 2018

- Understanding of Logistics Network Optimization - Why and How to Optimize a Logistics Network?

- Knowledge is Power A Safety Net for Your Shipments - Freight Forwarder is Liability Insurance ' Cargo Insurance'

- Powered by AI - Cello Forecasts the Future

- Achieving Greater Visibility 'Smart Containers'